First National Bank (FNB) offers a convenient and secure way to send money using its eWallet service. Whether you need to transfer funds to a friend, withdraw cash without a card, or reverse a payment, eWallet provides a user-friendly platform for managing your finances. This comprehensive guide will walk you through the steps of sending, withdrawing, and reversing eWallet payments.

What is FNB eWallet?

FNB eWallet is a mobile payment service that allows FNB customers to send money to anyone with a South African cellphone number. The recipient doesn’t need a bank account to receive the funds and can withdraw cash from an FNB ATM or participating retailers.

How to Send Money via FNB eWallet

Sending money via FNB eWallet is simple and can be done through FNB’s online banking, mobile app, or by dialing a USSD code. Here’s how:

Using the FNB App:

- Log In: Open the FNB mobile app and log in with your credentials.

- Select eWallet: Navigate to the “Payments” section and select “eWallet.”

- Enter Recipient Details: Enter the recipient’s cellphone number and the amount you wish to send.

- Confirm: Review the details and confirm the transaction. The recipient will receive an SMS with instructions on how to withdraw the funds.

Using Online Banking:

- Log In: Access your FNB online banking account.

- Select eWallet: Go to the “Payments” menu and choose “eWallet.”

- Enter Details: Input the recipient’s cellphone number and the amount you want to send.

- Confirm: Confirm the payment details and complete the transaction. The recipient will be notified via SMS.

Using USSD:

- Dial 120321#: From your registered cellphone, dial 120321# to access FNB’s mobile banking service.

- Select eWallet: Follow the prompts to select the eWallet option.

- Enter Details: Input the recipient’s cellphone number and the desired amount.

- Confirm: Confirm the transaction, and the recipient will receive the money.

How to Withdraw Money from FNB eWallet

Once the recipient receives an eWallet payment, they can withdraw the funds from an FNB ATM or participating retailers such as Shoprite, Checkers, or Spar. Here’s how:

At an FNB ATM:

- Visit an FNB ATM: Go to the nearest FNB ATM.

- Select eWallet Services: On the ATM screen, select “eWallet Services.”

- Enter Cellphone Number: Input the cellphone number associated with the eWallet.

- Enter PIN: The recipient will need to enter the PIN they received via SMS.

- Withdraw Cash: Select the amount to withdraw, and the ATM will dispense the cash.

At a Retailer:

- Visit a Participating Retailer: Go to a Shoprite, Checkers, or Spar store that supports eWallet withdrawals.

- Provide Cellphone Number: Inform the cashier you want to withdraw from eWallet and provide your cellphone number.

- Enter PIN: Enter the PIN sent to your phone via SMS.

- Receive Cash: The cashier will give you the cash amount you specified.

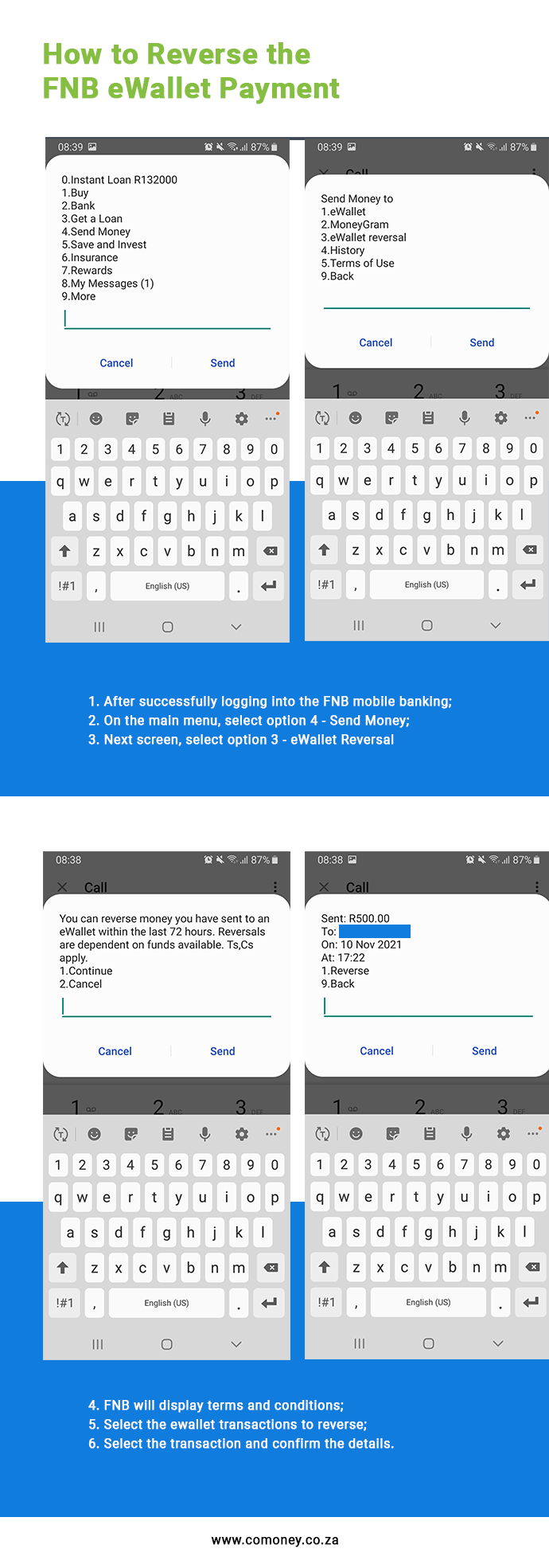

How to Reverse an FNB eWallet Payment

If you accidentally send money to the wrong recipient or need to reverse an eWallet transaction, FNB allows you to reverse the payment under certain conditions. Here’s how:

Contact FNB Customer Service:

- Call FNB: Immediately contact FNB customer service at 087 575 9405 to request a reversal.

- Provide Details: Give the customer service representative the transaction details, including the cellphone number and amount.

- Wait for Confirmation: FNB will review the request and, if eligible, reverse the payment. Note that the reversal process may take some time, and fees may apply.

Important Tips for Using FNB eWallet

- Double-Check Details: Always verify the recipient’s cellphone number before confirming a transaction to avoid sending money to the wrong person.

- Use Secure Channels: Ensure you’re using a secure network when accessing FNB’s mobile app or online banking to prevent unauthorised access.

- Keep Your PIN Safe: Do not share your eWallet PIN with anyone, and change it immediately if you suspect it has been compromised.

FNB eWallet offers a fast, convenient way to send, receive, and manage money, especially for those who don’t have a bank account. By following the steps outlined in this guide, you can easily send money, withdraw funds, and even reverse payments if necessary. Remember to double-check all details and keep your information secure to enjoy a hassle-free eWallet experience.